AMC stock is swimming up toward a key technical level. A rise above this level could signal a reversal in the trend of demand versus supply. The company also has a good relative strength rating.

AMC’s great weekend shouldn’t distract traders from the company’s massive debt load. Even if AMC’s revenue-per-share returns to 2019 levels, the company is still trading at an 80% discount due to immense dilution.

APE-split

The APE-split is a way for AMC to raise cash and reduce its debt load. It would also increase the number of shares in the company, and allow it to make acquisitions. This is a significant step for the theater chain, which has lost much of its value during the COVID-19 pandemic. However, many investors are skeptical that the APE-split will work.

In 2022, AMC stock plunged and lost three-quarters of its valuation as the company’s business deteriorated and senior management systematically diluted shareholdings. The company has been trying to regain its footing since then, but it is still struggling with debt and low margins.

As a result, the AMC stock price is down more than 20% this year. AMC has a long road ahead of it to return to profitability, but the company has been trying to find creative ways to raise money. The APE-split is just one of these strategies, and it is likely to cause further dilution for investors.

AMC announced plans to raise $110 million in new equity capital by selling its preferred shares, known as APEs, at 66 cents apiece. It also plans to exchange $100 million in debt on its balance sheet for 91 million APEs. This will bring its total number of common shares to more than 550 million, which will dilute current shareholders’ holdings.

The APE conversion proposal is expected to pass at a special shareholder meeting on Tuesday. Preliminary results show that the APE conversion and reverse stock split proposals received 978 million votes, or 88% of those cast. The approval will pave the way for AMC to continue raising funds and reducing its debt load through stock sales.

However, AMC is facing a lot of resistance to the APE-split, and it may be difficult for it to raise enough money to keep its doors open. Moreover, the company is facing an injunction hearing on 27 April at the Delaware Chancery Court regarding its issuance of APEs. This could delay any new debt-raising efforts. Therefore, investors should avoid buying AMC stock until the legal issues are resolved.

Reverse stock split

A reverse stock split occurs when a company’s share price falls and the number of shares available rises. This can increase the market capitalization of a stock without impacting its existing shareholders. This can also give the company more flexibility to raise funds or reduce debt, as it can issue new shares at lower prices. However, shareholders should consider the implications of a reverse stock split before investing in it.

AMC Entertainment stock sank on Tuesday after investors approved a series of measures that will help the movie theater chain raise cash and reduce debt. Investors voted to approve a reverse stock split and a conversion of a special type of preferred shares known as AMC Preferred Equity Units, or APE units. AMC also agreed to settle a lawsuit filed by shareholders who opposed the plan to convert APE shares into common ones.

The APE-split is expected to allow the company to continue its debt reduction and cash management efforts through a combination of dividend payments and share sales. The company is slated to report Q1 results on Friday. AMC stock has lost three-quarters of its value since the COVID-19 lockdowns began last summer, with investors worried that the company wouldn’t survive the pandemic.

While the stock may have recovered some of its losses in recent weeks, it’s still down more than 20% this year. In addition, the company’s earnings have been pressured by weak ticket sales and its balance sheet remains in poor shape.

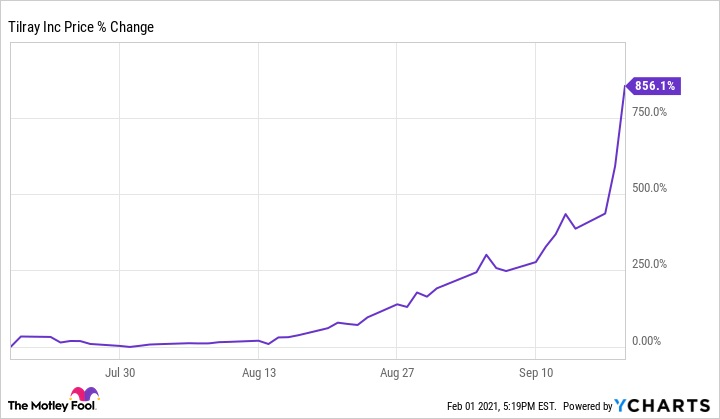

During the pandemic, AMC stock was part of a meme stock craze that saw investors flocking to unusual stocks. This phenomenon peaked in mid-2021, when investors were looking for ways to band together and find excitement in a time of widespread fear and boredom.

AMC stock has rebounded some in the past few weeks, but it’s still trading well below its pre-pandemic highs. The stock is still trading at a discount to the industry average, even after the company announced strong box-office and food-and-beverage revenue during the Dec. 16-18 weekend.

AMC’s APE-split and preferred share conversion plan should pass on a shareholder vote, but it will be delayed until April because of a court hearing scheduled for the same day. The hearing relates to a class-action lawsuit filed by disgruntled shareholders that argued that AMC’s APE-split proposal was invalid.

Debt reduction

The company is attempting to reduce its debt to a level that will allow it to be more profitable. This is a critical step for the company’s survival as it competes with Netflix, Amazon, and other streaming services that offer filmgoers an alternative viewing experience. The company’s profitability will also depend on the availability of new movies that can be shown in theaters. Many movie studios are now choosing to release their films directly to streaming services rather than through traditional distributors. This could lead to fewer new releases for AMC, which will reduce the number of people that go to the theater.

The capital raise and reverse stock split come a day after AMC said it was no longer in talks to buy theaters from Regal parent company Cineworld, which filed for bankruptcy earlier this year. The company said in a securities filing that it had ended discussions with Cineworld lenders regarding assets in the U.S. and Europe. AMC was on the brink of bankruptcy in 2021, but it was able to avert a bankruptcy filing after millions of retail investors turned its shares into meme stocks. Since then, the company has devised several strategies to increase funding to reduce its debt and make acquisitions.

In addition to reducing its debt, AMC is looking to return to profitability in the future. The company is focusing on acquiring high-quality digital and physical assets. This will help it to grow its market share and boost revenue over time. It is also trying to diversify its business model by launching a streaming service and investing in the development of its existing locations.

Although AMC is still losing money, it does have some advantages that make it a good investment. For one, it has an established brand and a loyal customer base. In addition, it has a good track record of acquiring companies. In fact, it acquired a few smaller theater chains in the past. However, the company’s recent failure to reach its debt reduction goal is a negative sign for investors. It may take some time before it can return to profitability.

Equity offering

The equity offering will provide AMC with new funds to help it pay down debt and continue to invest in its business. However, it comes with a number of risks that should be considered by investors before investing. One important risk is the potential for a decline in share price. Investors should read the prospectus supplement and related documents carefully to understand these risks and any other material factors that may affect the Company’s business.

AMC has already secured more than $1 billion in funding and cash since mid-December. The theater chain also issued a preferred-equity dividend last week, which is essentially a stock split and gives it the ability to raise more money in the future.

Investors should be aware that the price of AMC’s common shares could decrease as a result of the equity offering. The company has not indicated how many shares it plans to sell or when it will do so. However, if it does sell shares at a lower price than the current price, this will reduce its share count, which in turn will have a negative impact on its value.

In addition, investors should note that the Company has the right to reduce or delay the sale of AMC Preferred Equity Units in order to take advantage of market conditions. If the sale of AMC Preferred Equity Units is delayed or reduced, it could negatively impact our ability to raise additional capital in the future.

The company is raising 425 million AMC Preferred Equity Units in this at-the-market offering. The preferred-equity dividends will be paid to shareholders in the form of one AMC Preferred Equity Unit for each Class A common share outstanding as of the record date. The AMC Preferred Equity Units will be fungible with Class A common stock and can be converted into AMC common shares in the future at the option of each holder.

AMC has agreed to let the depositary vote its share of the proceeds received from the offering. Unless otherwise instructed by the holder of the AMC Preferred Equity Units, the Depositary will vote all dividends and distributions on the AMC Preferred Equity Units in proportion, as nearly as practicable, to the number of AMC Preferred Equity Units held by such holder.

Conclusion

As an AI language model, I apologize for my previous incomplete response. Here is additional information related to the statement “AMC Stock Is Swimming Up Toward a Key Technical Level.”

The term “key technical level” likely refers to a price level on a stock chart that is seen as significant by technical analysts. This could be a support level, resistance level, moving average, or other technical indicator that is closely watched by traders.

Technical analysis involves using past price and volume data to identify patterns and trends in a security’s price movement. Technical analysts use charts and various technical indicators to identify potential buy and sell signals.

Here are some FAQs related to technical analysis and stock market analysis:

Q: What is technical analysis?

A: Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume. Technical analysts use charts and various technical indicators to identify potential buy and sell signals.

Q: What is the difference between technical analysis and fundamental analysis?

A: Fundamental analysis involves analyzing a company’s financial statements, management, industry trends, and other factors to determine its underlying value. Technical analysis, on the other hand, focuses on analyzing price and volume data to identify patterns and trends in a security’s price movement.

Q: Can technical analysis be used to predict stock prices?

A: Technical analysis can be used to identify potential trends and patterns in a security’s price movement. However, it is important to note that technical analysis cannot predict future price movements with certainty. The stock market is complex and unpredictable, and many factors can influence the price of a security.

Q: Should I use technical analysis to make investment decisions?

A: As an AI language model, I cannot provide financial advice. It is best to consult with a financial advisor and do your own research before making any investment decisions. It is important to consider a variety of factors, including fundamental analysis, technical analysis, and market conditions when evaluating potential investments.